Kevin Hassett Has a Strategy to Become Fed Chair: If Trump Doesn’t Like His Principles, He Has Others

That this free market economist is singing the praises of tariffs and state ownership of companies means he’ll be the president’s puppet if appointed

One big difference between Donald Trump’s first term as president and his second is personnel. The first time, he had plenty of subordinates who were knowledgeable, capable, and unwilling to indulge his every whim. The roster of those who quit or were fired and went on to denounce him is long and includes National Security Advisor John Bolton, White House Chief of Staff John Kelly, Secretary of State Rex Tillerson, and Secretary of Defense James Mattis. They were among the proverbial grown-ups who helped to restrain Trump’s worst impulses, which meant he would not tolerate them for long.

This time, Trump has surrounded himself with a new cast of Cabinet officers and advisers known for their utter subservience and shameless flattery: Attorney General Pam Bondi, Secretary of State Marco Rubio, Secretary of Defense Pete Hegseth, and Homeland Security Secretary Kristi Noem, to name only the most prominent. There has been a radical change from his first administration to this one.

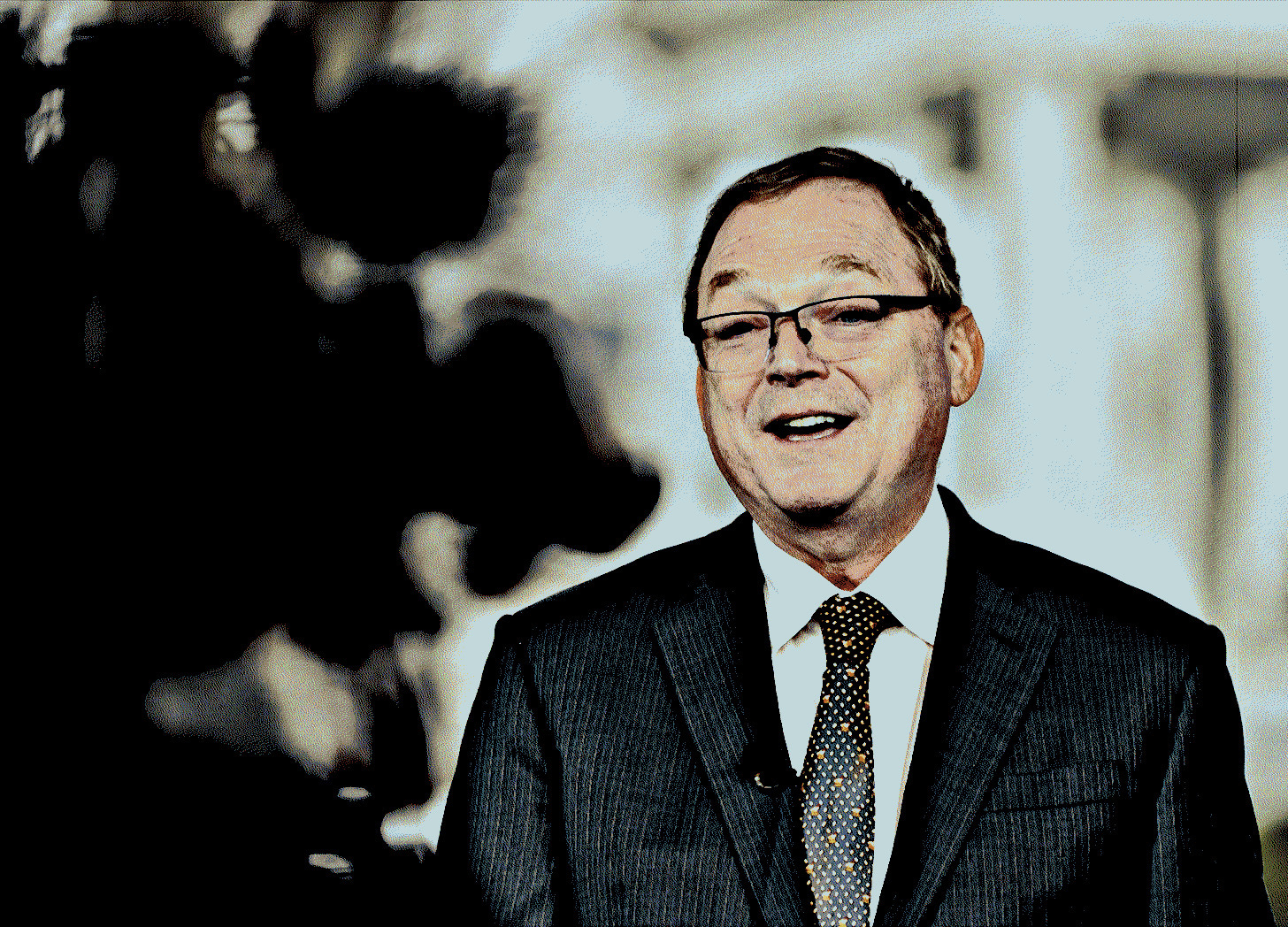

But not a complete change. One aide served him with supine fealty in the first term and is doing so again: Kevin Hassett. After two years chairing Trump’s Council of Economic Advisers, departing with a warm sendoff from the president in 2019, he returned in Jan. as director of the National Economic Council. Hassett has managed this impressive feat without the indignity of remaking himself to fit Trump’s new radicalism. That’s because Hassett had already demonstrated that he places loyalty to Trump and the MAGA cause above intellectual integrity or scholarly reputation. He fits perfectly into Trump 2.0.

So it comes as no surprise that Hassett may be Trump’s choice to replace Jerome Powell as chair of the Federal Reserve. Trump previously told The Wall Street Journal that Hassett and former Fed governor Kevin Warsh are at the top of his list.

The Return of the Sycophant

The Fed is designed to operate independently of the White House, free from pressure to pursue short-term goals that do long-run harm. Trump, bitterly resenting his inability to dictate monetary policy, has repeatedly slammed Powell for not cutting interest rates as much as he wants and said last month, “I’d love to fire his ass.” He wasn’t quite so coarse in yesterday’s address, although the message was still the same: “I’ll soon announce our next chairman of the Federal Reserve, someone who believes in lower interest rates by a lot, and mortgage payments will be coming down even further.”

Dictating the actual policy he wants the next chair to follow is a massive breach of the agency’s independence. And regardless of whether Trump fires Powell or waits till May 15, when Powell’s term ends, there is no doubt he will be replaced with a servile apparatchik. Trump believes the Fed should consult with him on its decisions. “I’m a smart voice and should be listened to,” he insisted. Trump has every reason to believe that if Hassett takes over at the Fed, he will do his best to deliver whatever Trump desires.

Hassett’s time in the White House confirms that there is no principle or insight of economics that he is not willing to discard to please his boss. When Trump spouts nonsense, Hassett is always there to offer a smiling, expert gloss on it. Last summer, when the Bureau of Labor Statistics revised its May and June calculations of job growth—a perfectly normal event—Trump fired the commissioner and claimed the report was “RIGGED in order to make the Republicans, and ME, look bad.” The NEC director promptly went on TV to back him up. Hassett asserted that the revision was the biggest since 1968, which was false, while offering no evidence of deception by the agency. He went on to say, “The president wants his own people there so that when we see the numbers, they’re more transparent and more reliable”—as if Trump had the slightest fondness for valid data.

Hassett is not above lying about the most basic and verifiable facts. Gasoline prices, he said recently, are “below $2 a gallon in a lot of places.” In fact, as AAA documented, there is and was no state where gas prices averaged as low as $2.

A Free Trader’s Apostasy

What is so remarkable about Hassett, though, is that he was once, in his own words, “an unabashed free-trader.” In 2008, he went so far as to praise Bill Clinton for his “aggressive pursuit of free trade.” In 2003, he wrote that “liberalized trade” is “a key ingredient in the recipe for prosperity.” But you can’t sup at Trump’s table without swallowing your convictions. Hassett had an epiphany that revealed to him the cruel unfairness of our free-trade agreements and the importance of reducing the trade deficit—which he, in a flight of fantasy, holds responsible for “hundreds of thousands of deaths from fentanyl.” Trump’s tariffs, he suggests, are the antidote. Any reputable economist can attest that tariffs will not necessarily reduce the trade deficit, which is merely the other side of our massive capital surplus, the result of foreigners investing in American assets. What could reduce it is the economic slowdown the tariffs threaten to cause, something that a man who was once a free-market economist at the conservative American Enterprise Institute understood perfectly well.

Indeed, in his 2021 book, The Drift: Stopping America’s Slide to Socialism, Hassett recounts how he battled Peter Navarro and other trade hawks over tariffs, a contest he lost. But he stayed on nonetheless, and when research indicated that the duties on washing machines created only a few jobs, and at an exorbitant cost, he insists that Trump “watched the evidence closely and adjusted his game accordingly.” Oh? The tariffs stayed in place till the end of his first term—and beyond, because Joe Biden extended them before letting them expire in 2023. And if you believe Trump cared about the evidence, I have a White House East Wing to sell you.

Hassett used to argue that chronic uncertainty about federal policy, which arose under President Barack Obama, impeded economic growth. But the Economic Policy Uncertainty Index, published by the St. Louis Federal Reserve, soared during the months after Trump returned to office—an increase largely attributable to the blizzard of tariffs he has imposed, suspended, modified, and restored—along with his mass deportation campaign that is reducing labor supply.

With Obama, sowing uncertainty was a byproduct of the administration’s economic policies. With Trump, sowing uncertainty is a conscious choice. But Hassett evinces far less concern about it now than he did before. In March, he expressed blithe confidence that the uncertainty would be gone by April. In fact, it remains high—well above the peak under Obama.

Nationalists In Favor of Nationalization

Then there is Trump’s insistence on giving the federal government a stake in private corporations. He extracted a “golden share” of U.S. Steel as the price to approve its merger with Nippon Steel of Japan, obtaining decisive personal leverage over the company. As Atlantic Council economist Sarah Bauerle Danzman wrote: “The company’s governance documents will outline the areas of strategic and operational decision making over which the U.S. president will now have veto authority. U.S. Steel may not be state-owned, but it is certainly now controlled by the U.S. government.” He agreed to let Nvidia sell artificial intelligence chips to China—on the condition that it turn over 25% of the revenue to the federal government. In August, Trump directed the purchase of 10% of the stock of Intel, similar to what he has done with several mining companies. Kentucky Republican Sen. Rand Paul accurately called that deal “a step toward socialism.”

We know how fiercely Hassett opposes anything that moves the U.S. toward socialism, because he wrote that book about it. “History shows that socialism always degrades a country, making its people where government control reaches into every corner of our lives,” he warned, while celebrating Trump as the guardian of our free market system. “The entire Donald Trump saga only makes sense if one views him as powerful opposition to the Left’s quest to defeat capitalism and turn the United States into a socialist country.”

For a man of principle with such beliefs, observing this alarming venture into partial nationalization would be grounds for resignation. But Hassett is not a man of principle—he’s a master of opportunistic amnesia. Rationalizing the Intel purchase by noting that Intel had gotten federal funds from the CHIPS Act, he offered this breezy defense: “The U.S. government is helping the business succeed and making it so that the taxpayer benefits if they’re successful at that.” And Hassett looks forward to more such incursions. “I’m sure that at some point there’ll be more transactions, if not in this industry then other industries,” he said.

Not perturbed by the obvious conflict of interest, he has also been a cheerleader for Trump’s crusade against Powell and the Fed. “Looking at the Fed’s actions over the past few years, one might wonder if political issues have been prioritized over their core mission,” he said, arguing that “there is a need for the board to be replaced.” After the Fed announced a quarter-point rate cut this month, he groused: “The fact is that they have been way behind getting the rates down. The economy is doing well but because of all the supply-side acts that we’ve taken. We’ve got high growth with declining inflation.”

High growth? In his dreams. Professional forecasters expect GDP growth to amount to 1.9% this year and 1.8% next year—down from 2.8% in 2024, the last year of Biden’s presidency. Declining inflation? It’s risen steadily under Trump, from an annual rate of 2.3% in April to 3% in Sept.—the same rate as Jan., when Biden left town. The Bureau of Labor Statistics reported today that the Nov. rate fell to 2.7%, but economists say the government shutdown hindered data collection too much to trust that number. “Take it with the entire salt shaker,” said one team of experts.

If you need further evidence of Hassett’s willingness to truckle, consider that in 2020, he devised a model that suggested Covid deaths would fall to zero by mid-May of that year, an outlook that mirrored Trump’s often absurd optimism. “Although Hassett denied that he ever projected the number of dead,” reported The Washington Post, “other senior administration officials said his presentations characterized the count as lower than commonly forecast—and that it was embraced inside the West Wing by the president’s son-in-law, Jared Kushner, and other powerful aides helping to oversee the government’s pandemic response.” In reality, 1.23 million Americans died from Covid, the vast majority of them after May 2020.

Trump is not subtle in conveying what he wants. “One percent and maybe lower than that,” he told the Journal. “We should have the lowest rate in the world.” His latest Fed appointee, Stephen Miran, was the only governor voting for a half-point reduction in the Fed’s Dec. meeting. Hassett says that if he joins the Fed, the president’s preferences “would have no weight.” But he also said that at the Fed, “I’d be happy to talk to the president every day, you know, until both of us are dead because it’s so much fun to talk.”

Hassett at the Fed Would Be Disastrous

For Trump to install Hassett atop the Fed would be the next closest thing to gaining direct control of the central bank. But central banks that operate independently have a far better record of restraining inflation than those that don’t. As Michael Klein, an economist at the Fletcher School of Diplomacy at Tufts University told me last year, “In recent decades, there has been a big move across countries to make central banks more independent, and that’s one reason we’ve seen less inflation compared to the 1970s and ‘80s.” And Trump, with his impulsive character and short-term fixation, would be especially dangerous if he were to gain control of monetary policy.

It is hard to picture Hassett, his reputation as an economist already shredded beyond repair, suddenly mustering the will to stand up to a president who has such a bent for retribution against those he perceives to do him wrong. (Powell, remember, was appointed by Trump.) Trump would not pick Hassett without great confidence that he will push the Fed governors to slash interest rates. If Chair Hassett were to refuse, he would undoubtedly find himself facing Trump’s wrath. That explains why a recent CNBC survey of financial experts found that while most think Hassett will get the Fed chair job, only 11% think he should.

Standing up to Trump requires intellectual integrity and courage, something that Hassett demonstrated he actively lacked during his White House tenure. A lackey atop the National Economic Council is bad enough. A lackey leading the Fed may well be a disaster.

© The UnPopulist, 2025

Follow us on Bluesky, Threads, YouTube, TikTok, Facebook, Instagram, and X.

We welcome your reactions and replies. Please adhere to our comments policy.

The documentation of Hassett's intellectual pivot is pretty damning, especially that shift from "unabashed free-trader" to tariff cheerleader. What really gets me is the COVID death projection to zero by mid-2020, that kind of model manipulation isn't just bad forecasting, it's policy malpractice when lives are at stake. I worked adjacent to some Fed watchers during the last rate tightening cycle, and the consensus was always that political pressure on monetary policy erodes credibility way faster than it delivers short-term gains. If he gets the chairmanship, expect markets to start pricing in inflatioin risk premium almost immediatly.

Excellent post, Steve.